The Cost-Benefit of Sustainable Mobility and the Supply of Lithium

MATIAS SHOCRON

COMMENTARY #38 • MARCH 2023

Sustainable solutions became the most prominent principle of public policies and private solutions. Transportation is one of the main polluting sectors, therefore, green means of transportation are encouraged. However, hybrid vehicles and other solutions of this type are composed of minerals which extraction process increases the levels of pollution globally. Moreover, the distribution of minerals in the world is concentrated in specific countries/regions with China as a champion. In the case of Europe, the region does not possess extensive mineral reserves for supplying its sustainable solutions. Therefore, the need for a trusted supplier and partner could be found in Latin America, a region full of minerals but with the lack of funds for R&D on alternative green ways of extraction.

Sustainable Urban Planification and Sustainable Transportation

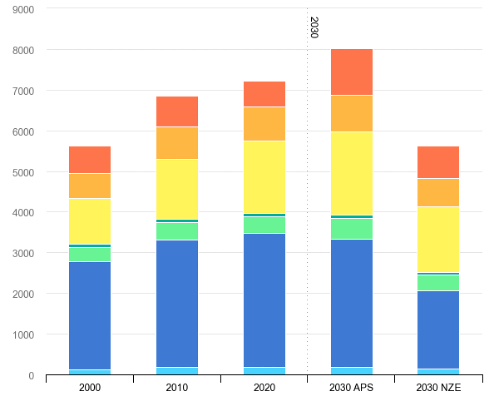

According to the Sustainable Development Goals (SDGs) by the United Nations (UN), in Goal 11: Sustainable cities and communities, sustainable transportation is pursued[1]. Therefore, cities around the world started to move towards means of transportation that contribute to this objective. According to IEA, by 2020 the emissions of on-ground transportation sum to 5754 MtCO2 out of the total of 7219 MtCO2 that transportation generates[2].

Different alternatives were proposed to reduce fossil-fueled transport, and Hybrid electric vehicles (HEV), fuel cell electric vehicles (FCEV), and electric vehicles (EV) are the most common ones. Electric vehicles (EVs) contribute to the decarbonization of transportation leading cities into decreasing their levels of CO2[3]. In the European Union, electric transportation is increasing. For example, in 2021 there was an increase of electric cars and vans sold by 1,729,000, compared to 1,061,000 in 2020[4]. Moreover, the Union passed a law that ensures all new cars and vans registered in Europe will be zero-emission by 2035[5]. This law and the trend toward green vehicles present a challenge when supplying the needed materials for this type of transportation.

Composition of Green vehicles, more of the problem or a green solution?

The technologies and engines used to produce sustainable vehicles are made with different scarce minerals in the world and their extraction process damages the environment. In the case of electric and hybrid cars, the battery is generally a lithium-ion one. For this battery minerals like lithium cobalt oxide (LCO), lithium manganese oxide (LMO), lithium iron phosphate (LFP), lithium nickel cobalt aluminum oxide (NCA), and lithium nickel manganese cobalt oxide (NMC) are used[6]. Being Lithium is the most relevant mineral to make an EV work, it is possible to see a rise in demand for it.

Governments around the world including the United States and the EU started legislation to increase the use of EVs to replace non-electric vehicles. According to analysts there is going to be a shortage of minerals needed mainly in the case of cobalt. For lithium, the problem is mostly related to the environmental consequences of its exploration[7]. The extraction of lithium has different environmental consequences. An average battery weighing 1,100 pounds emits over 70% more carbon dioxide than a conventional car. Moreover, extracting a ton of lithium it is required about 500,000 liters of water, which can also impact the health of the ecosystem surrounding the mines[8].

Lithium, where Europe fails Latin America succeeds: supply solution.

The EU wants to lead the transformation from conventional mobility to a sustainable one. However, to offer its citizens green vehicles it needs to guarantee the supply of needed minerals. The region is far from being a relevant supplier of Lithium in the world. Thus, the European market needs strategic partners in the world. Nevertheless, it is important to make a distinction between current producers of lithium and the biggest reserves in the world.

From a production perspective, the 5 leading countries are Australia (52%= 55.416 tons), Chile (25%= 26.000 tons), China (13%= 14.000 tons), Argentina (6%= 5.967 tons), and Brazil (1%=1.500 tons)[9]. However, for the future perspective, it is crucial to look at the reserves in the world. The top 5 in this case change the panorama. Bolivia leads the list with 21 million tons of lithium, Argentina (20 million tons), the United States (12 million tons), Chile (11 million tons), and Australia (7.9 million tons)[10].

Today, the rivalry in the production of alternative vehicles is between the US, China, and the EU. China and the US are self-sufficient in lithium from their territories (in the case of China the biggest producer today in the world). The EU nowadays is relying on lithium imports mainly from Australia and Canada[11]. However, the Union should find strong partners for the future supply to lead the market. Therefore, South American countries (60% of the global reserves of lithium) are crucial potential partners. The EU has advanced in negotiations with regional entities like MERCOSUR, however, stronger bilateral relations between the Union and each country should be pursued. For Argentina, Bolivia, and Chile, this is a unique opportunity to open their countries to foreign investment and open business opportunities with European leaders.

The South American countries started showing their interest in the world to welcome investments in the local miner. In the case of Argentina, it has two commercially operational salt flats in its northwestern provinces of Jujuy and Catamarca: Salar de Olaroz and Salar del Hombre Muerto. The Fernandez administration has reduced already taxes on mineral exports in 2021. Bolivia is home to the world’s largest salt flat (Salar de Uyuni). In 2018, a German firm signed a joint project with Bolivia’s state-owned company, Yacimientos de Litio Bolivianos (YLB). However, the political situation in the country during the last few years stopped the process. Lastly, Chile possesses the largest quantity of commercially viable lithium reserves in the world. However, in this case, the country’s lithium is divided between two entities, Albemarle (a U.S.-based company), and Sociedad Química y Minera de Chile (SQM)[12].

Towards a sustainable partnership, a circular sustainable process

This paper offers a three-step solution that constitutes a circular circuit between investment, production, and commercialization. The South American partners would supply the European producers with the needed minerals in this case. In exchange Europe will invest and buy these minerals from south America, securing the needed resources for their solutions. However, a mutual fund could be created to boost the promotion of sustainable practices when exploiting these types of minerals.

From a supply perspective, as stated before, Argentina, Bolivia, and Chile own the biggest reserves of lithium in the world. Since this mineral is the core of any sustainable vehicle, the world and Europe require exploitation and commercialization of this mineral. Consequently, these three countries’ governments should promote foreign investment for the exploitation of this resource. Therefore, supply and investment agreements could be made between the European Union and its industrial actors with the Latin American countries.

In Europe, different solutions were introduced for the French and German vehicle industries. However, South America was not a consideration for future supply. In this case, German brands signed an agreement of lithium supply with the mining group Rock Tech, a german-Canadian company that will extract its lithium from Georgia Lake in Ontario, Canada. Moreover, this project also consists of building for battery-grade lithium hydroxide in Guben, Brandenburg. They claim that they will be able to have enough lithium to produce 500,000 electric cars per year[13]. In France, the French mineral producer Imerys has a project to extract lithium to produce 700,000 EVs a year from 2028 at its Beauvoir site in Echassières (Allier, France)[14]. But are all these opportunities realistic enough to supply the European market with a future sustainable world?

The levels of reserves and current lithium production in the world suggest that minerals needed for EVs or other technologies are located outside the European continent. China and the United States are Europe’s two main competitors in the race for electric vehicles and sustainable solutions. It is important to mention that both countries are lithium self-sufficient, but have also invested in different regions mainly in Latin America.

On February 2023, President Joe Biden announced the building of a national network of 500,000 electric vehicle chargers along America’s highways and the goal of EVs making up at least 50% of new car sales by 2030. Moreover, “President Biden’s Bipartisan Infrastructure Law invests $7.5 billion in EV charging, $10 billion in clean transportation, and over $7 billion in EV battery components, critical minerals, and materials”. Along the same line, China wants electric vehicles to make up 40 percent of new cars sold by 2030[15]

As a consequence, seeing the increased competition, Europe needs a partner in the world in addition to its territorial lithium. Chile, Bolivia, and Argentina could become crucial partners in the race toward sustainable solutions and mobility. However, the challenge of green exploitation is still pending. A common investment fund between the two regions should be pursued to invest in Latin American land with green alternatives for lithium extraction.

The European green dream could become grey if solid partners are not found. The future is where the unexplored is explored and South America is waiting for joining the sustainable path with its natural resources.

References:

- Berg, R. C, and Sady-Kennedy, A.T, “South America’s Lithium Triangle: Opportunities for the Biden Administration,” October 19, 2021. https://www.csis.org/analysis/south-americas-lithium-triangle-opportunities-biden-administration

- Bhutada, G, “ This chart shows which countries produce the most lithium”, World Economic Forum, January 5, 2023, https://www.weforum.org/agenda/2023/01/chart-countries-produce-lithium-world/

- Conrad, J. “China Is Racing to Electrify Its Future”, Wired, June 29, 2022, https://www.wired.com/story/china-ev-infrastructure-charging/

- Economic Times, “Countries with largest reserves of lithium. Here’s the list”, Economic Times, February 14, 2023, https://economictimes.indiatimes.com/news/web-stories/countries-with-largest-lithium-reserves-heres-the-list/slideshow/97912447.cms

- Enuh, B.M, “What Materials are Used to Make Electric Vehicle Batteries?”, AZO Materials, November 2, 2022,https://www.azom.com/article.aspx?ArticleID=22142

- European Commission, “SUPPLY CHAIN CHALLENGES”, EU RMIS, https://rmis.jrc.ec.europa.eu/?page=analysis-of-supply-chain-challenges-49b749

- European Commission, “Zero emission vehicles: first ‘Fit for 55′ deal will end the sale of new CO2 emitting cars in Europe by 2035”, European Commission, October 28, 2022, https://ec.europa.eu/commission/presscorner/detail/en/ip_22_6462

- European Environmental Agency, “New registrations of electric vehicles in Europe”, EEA, October 26, 2022, https://www.eea.europa.eu/ims/new-registrations-of-electric-vehicles

- Hossain, M. S., Laveet Kumar, M. M. Islam, and Jeyraj Selvaraj. “A Comprehensive Review on the Integration of Electric Vehicles for Sustainable Development.” Journal of Advanced Transportation 2022, October 11, 2022, https://doi.org/10.1155/2022/3868388.

- IEA, “Global CO2 emissions from transport by subsector, 2000-2030”, IEA, n.d. https://www.iea.org/data-and-statistics/charts/global-co2-emissions-from-transport-by-subsector-2000-2030

- Imirys, “EMILI : Beauvoir Lithium Mining Project”, Imirys, n.d., https://emili.imerys.com/en

- Randall, C, “Rock Tech to build lithium plant in Germany”, Electrive.com, October 11, 2021, https://www.electrive.com/2021/10/11/rock-tech-to-build-lithium-plant-in-germany/#:~:text=Rock%20Tech%20Lithium%20is%20a,Georgia%20Lake%20in%20Ontario%2C%20Canada.

- Tedesco, M, “The Paradox of Lithium”, Columbia Climate School, January 18, 2023, https://news.climate.columbia.edu/2023/01/18/the-paradox-of-lithium/

- Tracy, B.S, “Critical Minerals in Electric Vehicle Batteries”, Congressional Research Service, August 29, 2022, https://crsreports.congress.gov/product/pdf/R/R47227#:~:text=The%20most%20commonly%20used%20varieties,anode%20in%20lithium%2Dion%20batteries.

- United Nations, “Goal 11: Make cities inclusive, safe, resilient and sustainable”, UN, n.d. https://www.un.org/sustainabledevelopment/cities/

[1] https://www.un.org/sustainabledevelopment/cities/

[2] https://www.iea.org/data-and-statistics/charts/global-co2-emissions-from-transport-by-subsector-2000-2030

[3] https://www.hindawi.com/journals/jat/2022/3868388/

[4] https://www.eea.europa.eu/ims/new-registrations-of-electric-vehicles

[5] https://ec.europa.eu/commission/presscorner/detail/en/ip_22_6462

[6]https://crsreports.congress.gov/product/pdf/R/R47227#:~:text=The%20most%20commonly%20used%20varieties,anode%20in%20lithium%2Dion%20batteries.

[7] https://www.azom.com/article.aspx?ArticleID=22142

[8] https://news.climate.columbia.edu/2023/01/18/the-paradox-of-lithium/

[9] https://www.weforum.org/agenda/2023/01/chart-countries-produce-lithium-world/

[10] https://economictimes.indiatimes.com/news/web-stories/countries-with-largest-lithium-reserves-heres-the-list/slideshow/97912447.cms

[11] https://rmis.jrc.ec.europa.eu/?page=analysis-of-supply-chain-challenges-49b749

[12] https://www.csis.org/analysis/south-americas-lithium-triangle-opportunities-biden-administration

[13] https://www.electrive.com/2021/10/11/rock-tech-to-build-lithium-plant-in-germany/#:~:text=Rock%20Tech%20Lithium%20is%20a,Georgia%20Lake%20in%20Ontario%2C%20Canada.

[14] https://emili.imerys.com/en

[15] https://www.wired.com/story/china-ev-infrastructure-charging/